Free Forex Trading Signals For 2.5.2026

It’s February 5, 2026, and today’s session felt like a proper wake-up call. Out of nowhere, we saw heavy selling pressure hit risk assets—sterling absolutely tanked, gold gave up a big slice of its recent gains, and Bitcoin took a serious dive. The dollar picked up strength in places, though USD/JPY barely moved. I’ve been poring over the charts tonight, and the sudden shift looks like a mix of profit-taking, positioning unwinds, and maybe some fresh macro concerns bubbling up. Short-term momentum has turned defensive, but I’m not convinced the bigger trends are broken yet. These signals are my personal technical outlook based on today’s price action and the levels that stand out. Trade with caution—volatility is back, and risk management matters more than ever.

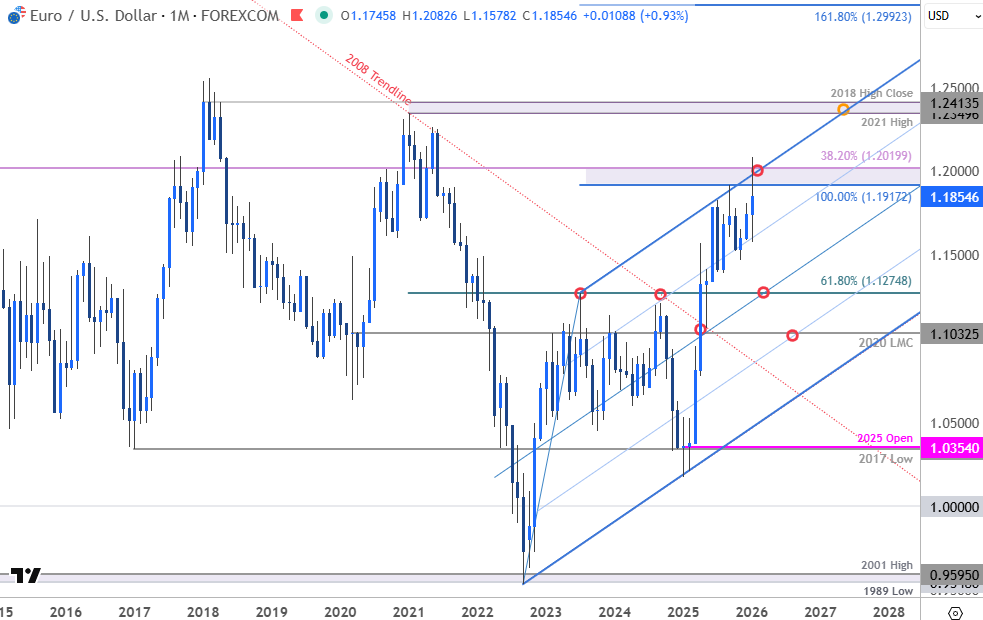

EUR/USD

Current Price: 1.1804

EUR/USD pulled back today but managed to stay relatively composed, holding above the 1.1800 figure despite the broader dollar bid. The daily chart still shows a series of higher lows from the past few months, and momentum indicators have cooled but haven’t flipped fully bearish. For me, this feels like a healthy pause in an otherwise bullish setup—worth watching for dip-buying opportunities if we stabilize here.

Signal Summary:

- Bias: Bullish on dips

- Entry: Buy 1.1770–1.1810 area

- Stop Loss: 1.1725

- Take Profit: 1.1900 (initial target), 1.1960 (extension)

- Still leaning long-term bullish—let sellers exhaust first.

GBP/USD

Current Price: 1.3589

Cable had a brutal day, breaking lower with real force and wiping out recent supports. The pound’s earlier strength evaporated quickly, and shorter-term charts now show clear bearish momentum. Whether this was UK-specific noise or part of the broader risk-off move, the technical damage is done for now—I’m favoring shorts on any bounce until we see a proper reversal pattern.

Signal Summary:

- Bias: Bearish

- Entry: Sell 1.3610–1.3650 (on retracement)

- Stop Loss: 1.3700

- Take Profit: 1.3480 (first target), 1.3380 (deeper)

- Momentum favors sellers—fade strength for now.

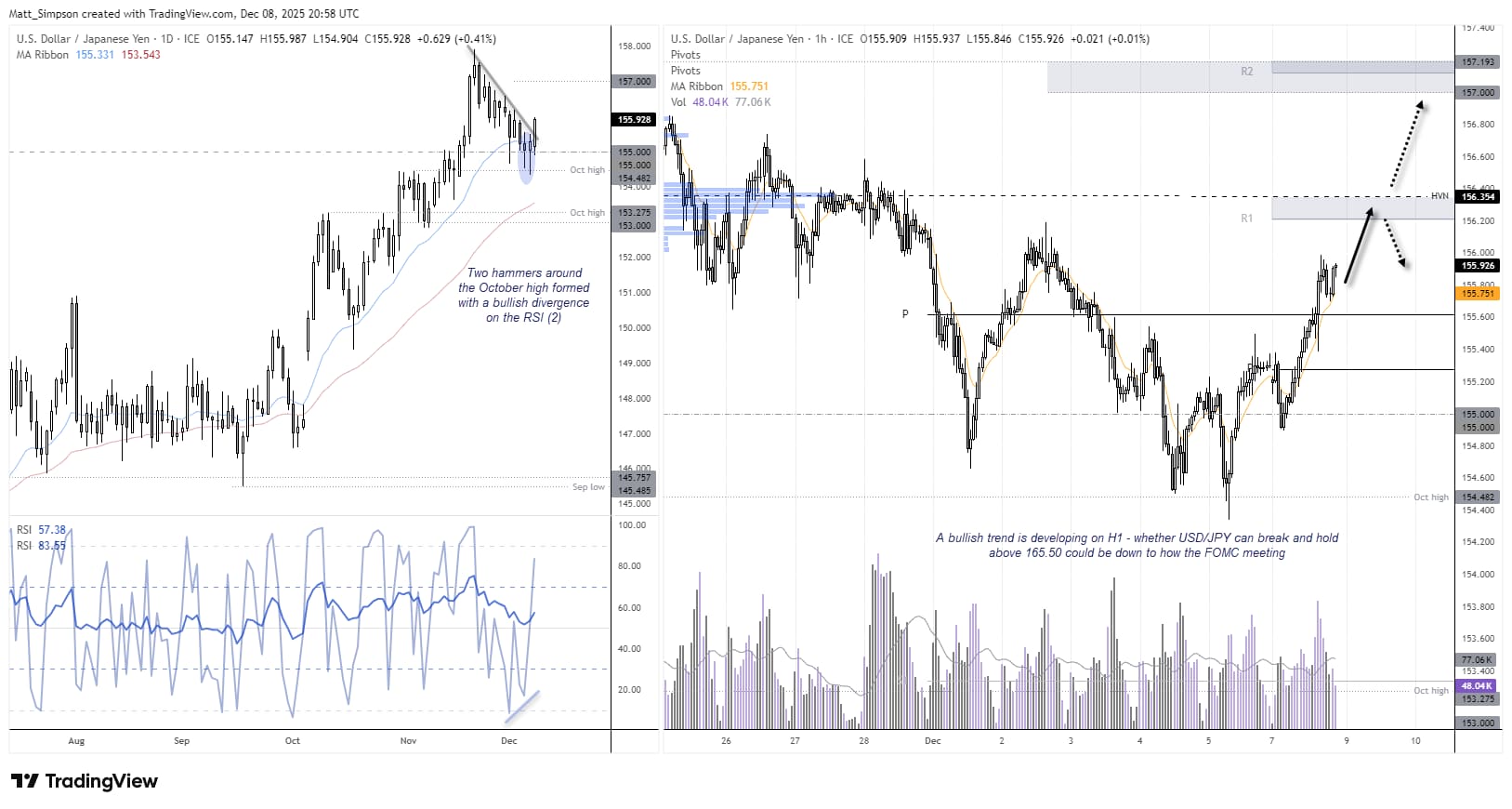

USD/JPY

Current Price: 156.64

USD/JPY stayed remarkably calm amid the chaos, trading in a narrow range and showing little directional conviction. The pair is still overbought on higher timeframes, and today’s lack of upside follow-through reinforces that caution. I’m keeping a neutral stance here—waiting for a clear break before committing.

Signal Summary:

- Bias: Neutral with mild downside preference

- Entry: Sell near 157.00–157.70

- Stop Loss: 158.30

- Take Profit: 155.20 (initial), 154.00 (extension)

- Range trading or wait for catalyst.

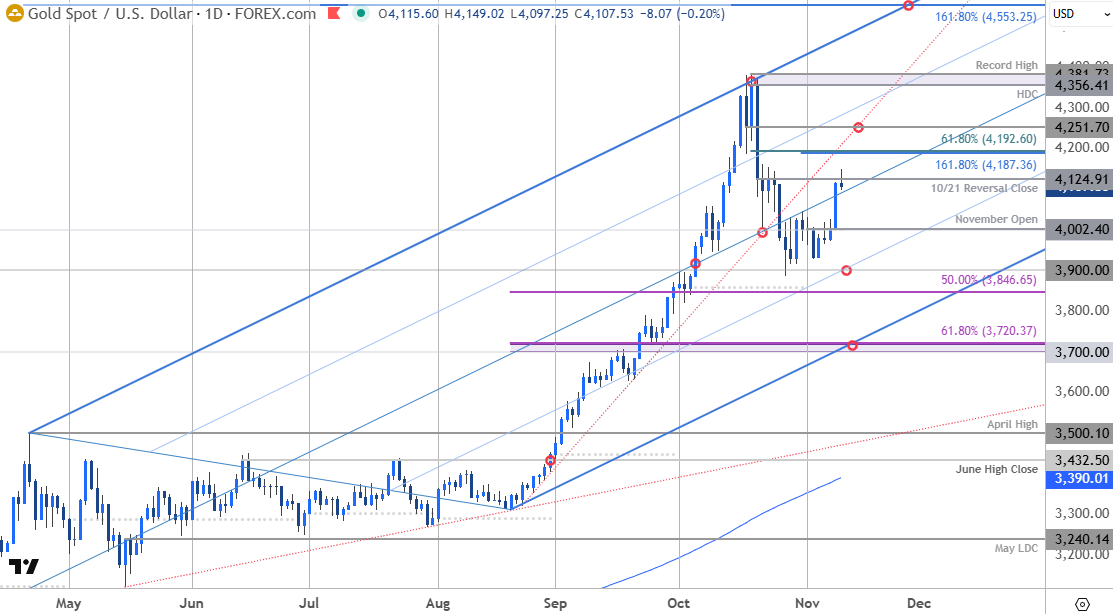

Gold (XAU/USD)

Current Price: 4861.21

Gold got caught in the risk-off storm and dropped sharply, giving back much of yesterday’s lofty levels. That said, corrections like this are normal in strong bull markets—often shaking out late longs before resuming. The underlying drivers (central banks, inflation hedges, geopolitics) haven’t gone away, so I’m viewing this pullback as a potential setup for re-entering longs.

Signal Summary:

- Bias: Bullish on deeper pullback

- Entry: Buy 4820–4880 zone

- Stop Loss: 4760

- Take Profit: 4960 (first), 5050+ on recovery

- Patience pays in trends like this—don’t chase, wait for confirmation.

BTC/USD

Current Price: 69602.35

Bitcoin led the downside today, falling hard as risk appetite vanished. The move was swift and deep, but we’re now approaching areas that have acted as support in previous corrections. Bull cycles always have these violent shakeouts—I’m looking for signs of capitulation before adding exposure.

Signal Summary:

- Bias: Bullish on strong support

- Entry: Buy 68800–70200 range

- Stop Loss: 66800

- Take Profit: 75500 (initial), 81000+ on rebound

- Scale in carefully—crypto corrections can overshoot.

Summary Table – February 5, 2026 Signals

| Asset | Current Price | Trend Bias | Signal | Entry Point | Stop Loss | Take Profit |

|---|---|---|---|---|---|---|

| EUR/USD | 1.1804 | Bullish on dips | Buy | 1.1770–1.1810 | 1.1725 | 1.1900 / 1.1960 |

| GBP/USD | 1.3589 | Bearish | Sell | 1.3610–1.3650 | 1.3700 | 1.3480 / 1.3380 |

| USD/JPY | 156.64 | Neutral/downside lean | Sell near resistance | 157.00–157.70 | 158.30 | 155.20 / 154.00 |

| Gold (XAU/USD) | 4861.21 | Bullish on pullback | Buy | 4820–4880 | 4760 | 4960 / 5050+ |

| BTC/USD | 69602.35 | Bullish on support | Buy | 68800–70200 | 66800 | 75500 / 81000+ |

That’s my wrap-up for a turbulent day. Things can change quickly, especially with fresh data on the horizon this week. Stay disciplined, protect capital, and trade well tomorrow!

These awards confirm our commitment to building a rewarding trading environment and helping you uncover your potential. Thank you for choosing to trade with an award-winning broker!

Choose MetaTrader 5 with Top Forex Brokers?

•Blazing-fast execution & enhanced stability

•38 built-in technical indicators & 21 timeframes for precision trading

•Optimized for all devices—desktop, mobile & web

•Trade a wide range of assets: Stocks, Commodities, Forex & more!

https://www.topforexbrokerscomparison.com

Disclaimer: These forex trading signals are for educational purposes only and not financial advice. Trading carries significant risks, including the potential loss of your entire investment. Always consult a professional advisor before jumping in.