Free Forex Trading Signals For 2.10.2026

It’s February 10, 2026, and the markets have kept the positive momentum going into the early part of the new week. Yesterday’s strong rebound has largely held up—euro and sterling are still elevated against the dollar, USD/JPY has continued sliding, and gold pushed fresh highs. Bitcoin gave back some ground today, but nothing that threatens the broader recovery tone. Risk appetite feels solid again after last week’s scare, with dollar bears firmly in control for now. I’ve been watching these levels all evening, and the setups still lean toward counter-dollar trades. Here are my latest reads and signals based on today’s price action. As always, trade with proper risk management—these markets don’t hand out free wins.

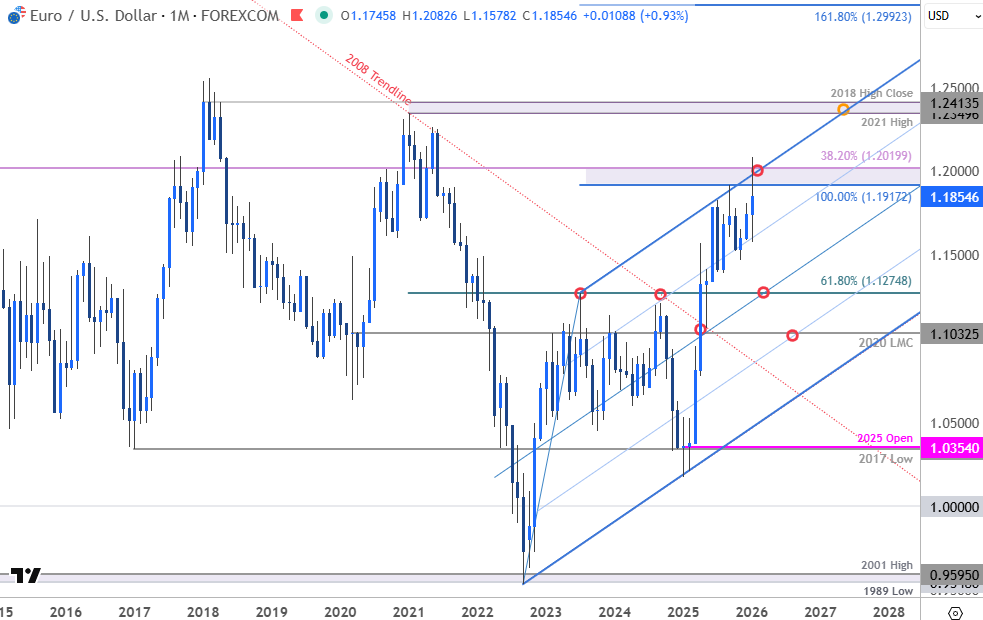

EUR/USD

Current Price: 1.1918

EUR/USD eased off a touch from yesterday’s push but stayed comfortably above 1.1900, showing buyers are still active on any weakness. The daily chart continues to look bullish—higher lows intact, momentum indicators positive—and this minor dip feels like normal consolidation within the uptrend. I’ve stayed long euro for a while now, and nothing today changes that conviction.

Signal Summary:

- Bias: Bullish

- Entry: Buy 1.1890–1.1920 zone

- Stop Loss: 1.1850

- Take Profit: 1.2000 (initial target), 1.2050 (extension)

- Dips continue to look like opportunities—trend strength is solid.

GBP/USD

Current Price: 1.3678

Cable extended its rebound today, grinding higher and showing real resilience. The pound is once again outperforming the euro, with clean higher highs and strong support on pullbacks. Sterling rallies often have staying power when dollar sentiment turns like this—I’m liking the structure here.

Signal Summary:

- Bias: Bullish

- Entry: Buy 1.3640–1.3685

- Stop Loss: 1.3590

- Take Profit: 1.3780 (first target), 1.3850 (stretch)

- Keeping longs open—momentum favors buyers.

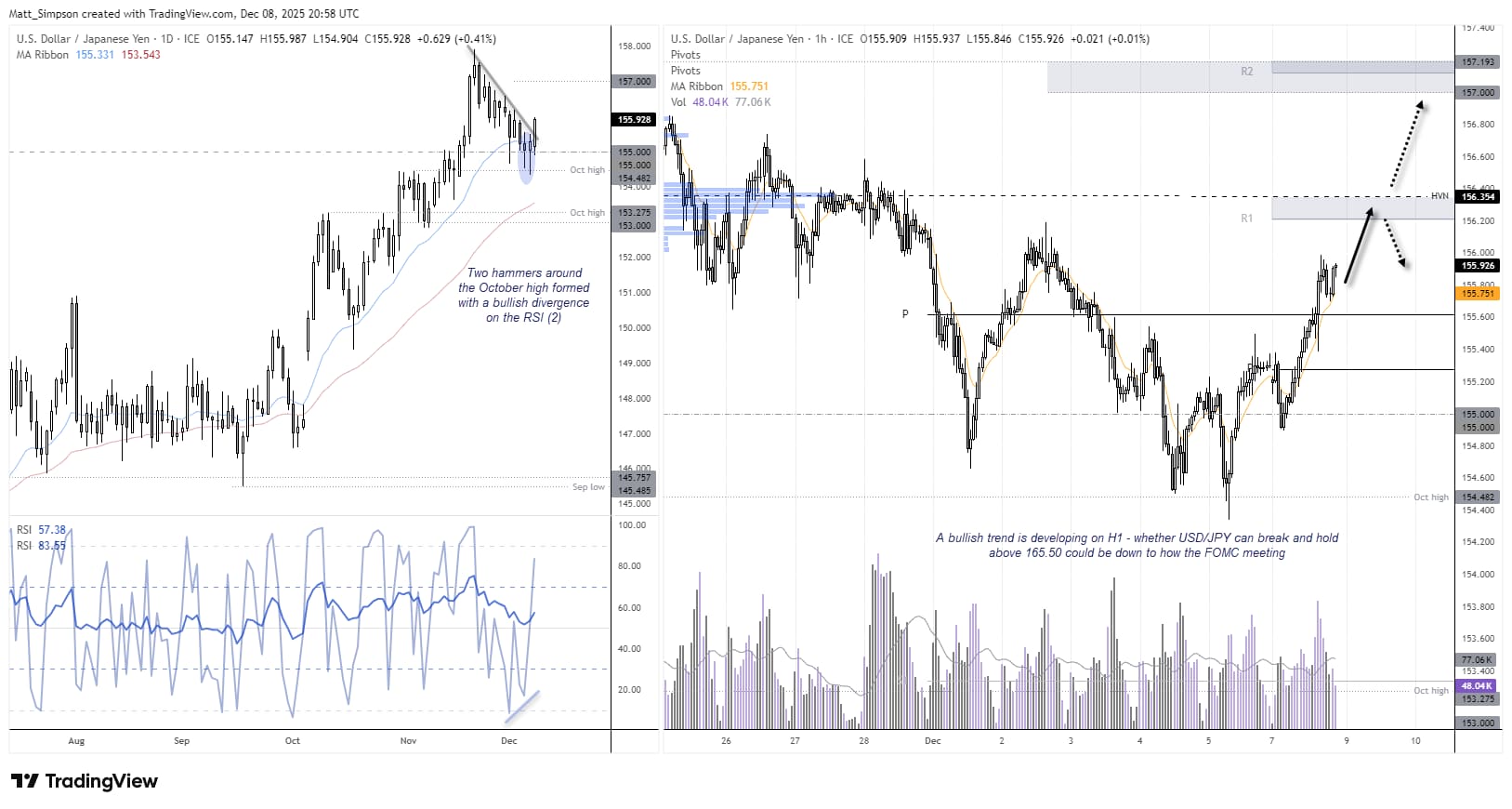

USD/JPY

Current Price: 154.33

USD/JPY continued its decline today, dropping further as yen bids returned alongside broader dollar weakness. The pair has now retraced a good portion of its earlier overextension, and downside momentum looks intact short-term. These pullbacks can deepen quickly when carry unwinds—I’m staying cautious on longs.

Signal Summary:

- Bias: Bearish

- Entry: Sell 154.80–155.30 resistance

- Stop Loss: 156.00

- Take Profit: 153.50 (initial), 152.50 (deeper)

- Favor shorts on bounces until upside reasserts.

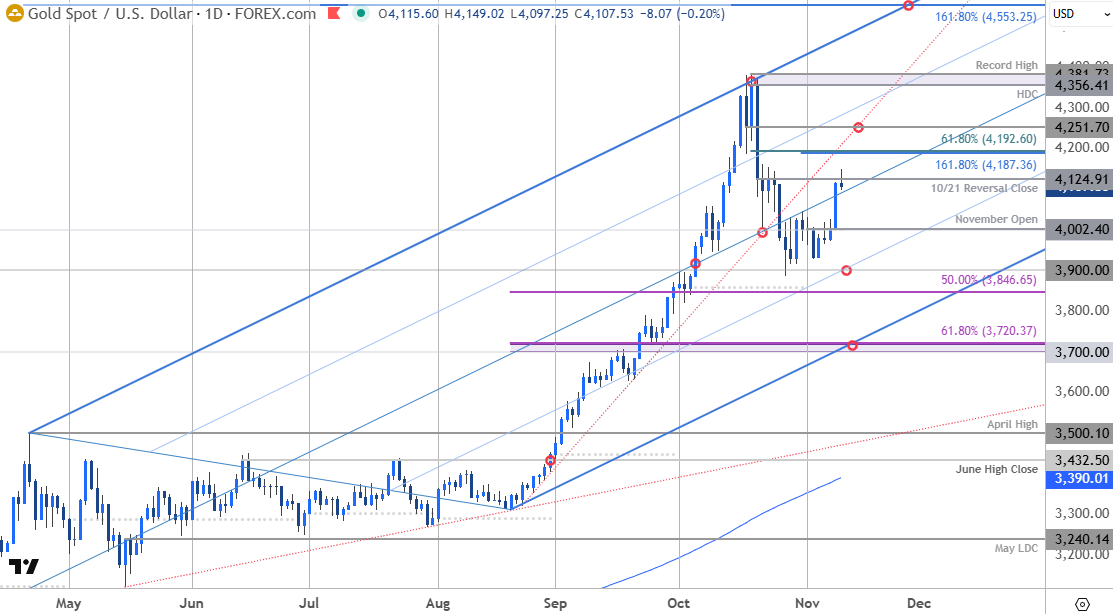

Gold (XAU/USD)

Current Price: 5054.87

Gold powered to new highs today, breaking cleanly higher and confirming the bull market’s strength. Shallow pullbacks keep getting bought aggressively, and the macro drivers remain perfectly aligned. This run has been one of the cleanest trends I’ve traded in years—still no reason to fight it.

Signal Summary:

- Bias: Strongly bullish

- Entry: Buy 5030–5060 zone

- Stop Loss: 4980

- Take Profit: 5120 (next target), trail higher

- Core longs stay firmly in place—let it run.

BTC/USD

Current Price: 68180.45

Bitcoin pulled back modestly today after yesterday’s recovery, but support held firm and the overall structure remains constructive. These corrections are normal breathing room in bull cycles—buyers continue to defend key zones, and risk sentiment supports higher prices longer term.

Signal Summary:

- Bias: Bullish on dips

- Entry: Buy 67500–68500 range

- Stop Loss: 66000

- Take Profit: 72000 (initial), 76000+ on strength

- Scale in on weakness—uptrend still very much alive.

Summary Table – February 10, 2026 Signals

| Asset | Current Price | Trend Bias | Signal | Entry Point | Stop Loss | Take Profit |

|---|---|---|---|---|---|---|

| EUR/USD | 1.1918 | Bullish | Buy | 1.1890–1.1920 | 1.1850 | 1.2000 / 1.2050 |

| GBP/USD | 1.3678 | Bullish | Buy | 1.3640–1.3685 | 1.3590 | 1.3780 / 1.3850 |

| USD/JPY | 154.33 | Bearish | Sell near resistance | 154.80–155.30 | 156.00 | 153.50 / 152.50 |

| Gold (XAU/USD) | 5054.87 | Strongly bullish | Buy | 5030–5060 | 4980 | 5120 / Higher |

| BTC/USD | 68180.45 | Bullish on dips | Buy | 67500–68500 | 66000 | 72000 / 76000+ |

That’s my take heading into tomorrow. Markets are looking healthier again this week—keep an eye on those key levels and any fresh headlines. Trade well and stay safe out there!

These awards confirm our commitment to building a rewarding trading environment and helping you uncover your potential. Thank you for choosing to trade with an award-winning broker!

Choose MetaTrader 5 with Top Forex Brokers?

•Blazing-fast execution & enhanced stability

•38 built-in technical indicators & 21 timeframes for precision trading

•Optimized for all devices—desktop, mobile & web

•Trade a wide range of assets: Stocks, Commodities, Forex & more!

https://www.topforexbrokerscomparison.com

Disclaimer: These forex trading signals are for educational purposes only and not financial advice. Trading carries significant risks, including the potential loss of your entire investment. Always consult a professional advisor before jumping in.